[图一]

根据财务报表列报准则的规定,资产负债表上资产和负债应当按照流动性分别分为流动资产和非流动资产、流动负债和非流动负债列示。流动性,通常按资产的变现或耗用时间长短或者负债的偿还时间长短来确定。

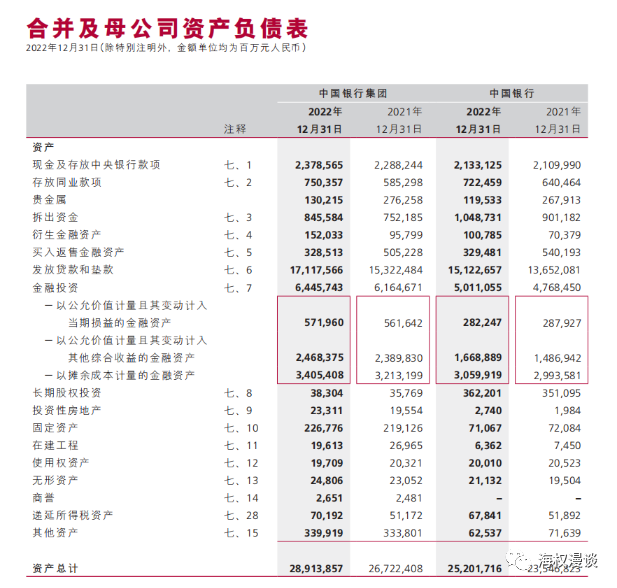

对于一般企业(比如工商企业)而言,通常在明显可识别的营业周期内销售产品或提供服务,应当将资产和负债分别分为流动资产和非流动资产、流动负债和非流动负债列示,有助于反映本营业周期内预期能实现的资产和应偿还的负债。但是,对于银行、证券、保险等金融企业而言,有些资产或负债无法严格区分为流动资产和非流动资产,而大体按照流动性顺序列示往往能够提供可靠且更相关的信息。

2023年CPA会计教材:第二十三章 财务报告——第二节 资产负债表——二、资产和负债按流动性列报

The separate presentation of current and non-current assets and liabilities enables an analyst to examine a company's liquidity position (at least as of the end of the fiscal period).

Both IFRS and US GAAP require that the balance sheet distinguish between current and non-current assets and between current and non-current liabilities and present these as separate classifications.

An exception to this requirement, under IFRS, is that the current and non-current classifications are not required if a liquidity-based presentation provides reliable and more relevant information.

A liquidity-based presentation, rather than a current/non-current presentation, is used when such a presentation provides information that is reliable and more relevant. With a liquidity-based presentation, all assets and liabilities are presented broadly in order of liquidity.

Entities such as banks are candidates to use a liquidity-based presentation.

CFA LEVEL 1教材

——————————————————————————————

[注1]大企业确实牛逼,连年报都是自有格式,彩色印刷

另,财务报告取自中国银行的官方网站,有需要可自行下载(https://www.boc.cn/investor/ir3/202304/t20230428_22977412.html)

[注2]这一点其实就是遵循了会计信息质量要求里面有“相关性”的要求。相关性通俗来讲,就是反映会计信息的时候要反映对于决策有用的信息,没用的信息别瞎反应。

[注3]第二十三章 财务报告——第二节 资产负债表——二、资产和负债按流动性列报